Richard Fagan heads a group of serial investment fraudsters, most of whom are British or Irish and several of whom play polo on the international circuit, including Fagan himself, who has represented Ireland. He first appeared on OffshoreAlert's radar in 2015 when we exposed his Kijani Commodity Fund, which perpetrated a $98 million investment fraud with the assistance of Mauritius-based corporate services group Belvedere before both Kijani and Belvedere collapsed after our exposé. Recently, Fagan has been involved with Ocean Polymers, which raised funds from investors to 'clean up the world's oceans' without actually doing so, and Coworth Investments and Novus Money, whose schemes have included a fake Swiss bank and crypto investing. Despite committing one crude investment scam after another over many years, Fagan appears to operate with impunity.

Investigations

- Home

- Investigations

Richard Fagan

BUSTED: British & Irish expats who help Belvedere Group swindle investors

One day after new directors were appointed to 'ensure' that Cayman-domiciled Brighton SPC would be operated legally, the Fund illegally acquired a Gibraltar firm with bogus assets of $125 million, OffshoreAlert can reveal. The transfer allowed Belvedere and its accomplices in Britain, Dubai, Gibraltar, Spain and elsewhere to continue securities frauds involving firms listed on stock exchanges in Denmark, England and Germany.

Argentarius/iMaps Capital

Austrian Andreas Woelfl provides cheap investment vehicles with a veneer of credibility that allow fraudsters to circumvent regulations and capital requirements so they can more easily swindle victims. He did so in Liechtenstein with Minerva Investments, which closed down amid allegations of fraud; then in Malta with Argentarius Group, which closed down amid allegations of fraud, and is now doing so in the Cayman Islands with iMaps Capital, which is essentially Argentarius under another name. When OffshoreAlert interviewed Woelfl in 2017 and asked him about Argentarius’ Exchange Traded Instruments, he bizarrely claimed that his group “does not operate an ETI program”, even though ETIs were its sole or primary product.

Malta's Argentarius Group kicked off Gibraltar Stock Exchange

Argentarius Group, which operates investment platforms in Malta, Gibraltar and the Cayman Islands on which several suspect schemes have been trying to raise funds, has been kicked off the Gibraltar Stock Exchange.

Symtomax

In January 2020, OffshoreAlert revealed that a British/Portuguese group called Symtomax was raising funds from investors by falsely claiming in offering and promotional material that it been issued a license to manufacture and distribute medical cannabis from Portuguese regulator INFARMED, even including a fake license number in one document. We also disclosed that the group's main principals, Paul Segal and Minette Coetzee, a.k.a. Minette Compson, were serial fraudsters whose prior investment scams include Advalorem Value Asset Fund, which swindled four British pension funds out of £7.7 million, and Privilege Wealth, whose investors were defrauded of more than £40 million before it collapsed after being exposed by OffshoreAlert. Compson was also a disqualified company director in Gibraltar. Despite OffshoreAlert sending INFARMED proof of Symtomax's fraud, the regulator did not consider it to be a deal-breaker and, incredibly, issued the group with a real license two years later.

EXPOSED: Symtomax Group's fraudulent €12M Bond Offering

A €12 million bond offering by British nationals Minette Coetzee, a.k.a. Minette Compson, and Paul Segal via their Symtomax Group for a purported medical cannabis production facility in Portugal is fraudulent, OffshoreAlert can reveal. The scheme involves entities and individuals in the BVI, Canada, Dubai, England, Gibraltar, Morocco, Netherlands, Panama, Portugal, Scotland, Spain, South Africa, and Switzerland.

Arbitrade/Dignity Gold

Exposed by OffshoreAlert in 2019, Arbitrade perpetrated a cryptocurrency-based investment fraud that raised more than $40 million, with investors told their digital assets were backed by billions of dollars of gold that, in reality, did not exist. Despite the crude nature of Arbitrade's scheme and the fact that several of its principals had histories of lawsuits, judgments, tax liens, and involvement with prior scams, Bermuda Premier David Burt welcomed the company, claiming its operators had passed "enhanced due diligence" and "background checks". Burt's claims were difficult to take seriously given that Arbitrade’s principals included an undischarged bankrupt whose Trustee accused of perpetrating a $3.5 million Ponzi scheme against "friends" and "family”, a penny stock broker whose previous employers include six broker-dealers that U.S. regulators had expelled from the securities industry after committing fraud, and a Canadian concert promoter and multi-level marketer against whom eight judgments for more than C$372,000 had been entered in Ontario in 2008-2009 alone. Arbitrade morphed into Dignity Gold, with New York-based property developer Kent Swig among the principals. The new version of the scheme was given credibility by news outlets reporting - as though it were fact - that it was backed by “a minimum of $6 billion in gold reserves”, notwithstanding the fact that Swig was being sued at the time by JPMorgan Chase Bank over an allegedly unpaid credit card debt of $33,982 . Nearly two years after OffshoreAlert’s exposé, the assets of the scheme’s founder, Troy Hogg, were frozen by the Ontario Securities Commission as part of a fraud investigation into Arbitrade/Dignity Gold.

EXPOSED: Bermuda cryptocurrency firms Uulala and Arbitrade

Two of Bermuda's new blockchain start-ups - Uulala Ltd. and Arbitrade Ltd. - are being operated by North Americans with long records of business failures, indebtedness, and scandal, OffshoreAlert can reveal.

Belvedere Group

Owned by Irishman David Cosgrove and South African Cobus Kellermann, Mauritius-based Belvedere Group provided dishonest fund administration, investment management, insurance, marketing, and other services that allowed its clients to swindle more than $100 million from investors and launder the proceeds. After being exposed by OffshoreAlert in 2015, Belvedere Group was quickly closed down by regulators in Mauritius, Guernsey, and the Cayman Islands, citing widespread illegal activity, and three participants were disqualified as company directors in Mauritius, including Cosgrove. One of the most extraordinary aspects of OffshoreAlert's investigation was the conduct of South African news service Moneyweb, through its reporter Patrick Cairns and editor Ryk van Niekerk, which repeatedly published false and misleading information that portrayed Belvedere and its principals as victims, despite overwhelming evidence to the contrary from regulators in three jurisdictions, forensic investigators, OffshoreAlert, and even Belvedere's own auditor.

EXPOSED: Belvedere Management's massive criminal enterprise

Offshore fund group Belvedere Management, which claims to have $16 billion of assets under administration, management and advisory, appears to be one of the biggest criminal financial enterprises in history, headed by David Cosgrove, Cobus Kellermann and Kenneth Maillard, OffshoreAlert can reveal.

Privilege Wealth

Privilege Wealth’s “low-risk, high-return” investment scheme swindled more than £40 million from investors, who were offered “insured” annual returns of 12% that would purportedly come from investment in payday loans offered by the Sioux Tribe in the USA. After OffshoreAlert revealed in October 2016 that it was a scam masterminded by Spain-based British fraudster and disqualified company director Brett Jolly, new investment fell by 85% from £494,000 to £76,000 per month, according to the company itself in a libel action that it filed against OffshoreAlert's publisher at the High Court in London, which he did not defend because foreign libel judgments are unenforceable in the U.S. under the SPEECH Act, which was introduced in 2010 to combat Britain's crime-friendly defamation laws. Demonstrating why the Act was needed in the first place, British judge Richard Davison, a.k.a. "Master Davison", stated in his default judgment that Privilege Wealth’s scheme "is far from being a fraud” and that he needed to issue “a substantial award, both to compensate the claimant and to provide a public marker that the allegations were untrue” to deter existing investors from requesting “early redemption” and, presumably, new investors from investing. We hope that no-one listened to Davison's nonsense but it became moot a mere 22 days later when Privilege Wealth’s scheme was suspended after the head of its Panama call center was shot and wounded in what Davison might have described as “far from being an attempt to kill”. Given the crude nature of Privilege Wealth’s fraud and that it was targeting British pensioners, Davison’s comments in his ruling were particularly reckless and irresponsible. A special mention also to one of the English lawyers who represented Privilege Wealth in its libel action … Jonathan Coad, a self-described “committed Christian” who, nevertheless, took on a client that was in breach of at least two of the 'Ten Commandments'. Divine justice was done, however, when Privilege Wealth apparently didn't pay its legal fees, causing Coad's employer, law firm Lewis Silkin, to make a claim for £45,000 when Privilege Wealth went into administration.

EXPOSED: 'Privilege Wealth' global investment fraud

Notorious British swindler Brett Jolly is secretly behind a global investment fraud being perpetrated under the name 'Privilege Wealth', OffshoreAlert can reveal. The scheme involves a sprawling web of companies and operators in Bermuda, BVI, Cayman Islands, Curacao, Dubai, Gibraltar, Guernsey, Jersey, Luxembourg, Panama, Seychelles, South Africa, Spain, UK, and USA.

Axiom Legal Financing Fund

After OffshoreAlert exposed Axiom Legal Financing Fund in August 2012, the litigation funding-based investment scam quickly collapsed and 12 British attorneys were later struck off, including the scheme's principal, Timothy Schools, who misappropriated most of the approximately £100 million that was raised from investors and was convicted of fraud and money laundering in England in 2022, for which he was sentenced to 14 years in prison. A special shout out to David McIntosh QC, a former president of the Law Society of England and Wales who represented Schools in a libel complaint against OffshoreAlert, threatened to sue a London hotel if we mentioned his client's scam at a conference we were holding there, and - without a hint of irony - questioned OffshoreAlert’s “integrity”, all on behalf of a person that even cursory due diligence would have shown to be a crook. It's also worth mentioning that London’s Metropolitan Police issued OffshoreAlert's publisher with an ‘harassment warning’ and threatened him with arrest after Schools' adult daughter, Lisa Schools, who was “Senior Administrator/Office Manager" of two firms that participated in the fraud, including one that received more than £50 million, made false allegations against him. Given that Timothy Schools is a former policeman, it was difficult not to believe that the notoriously corrupt Met was simply doing him a favor.

More red flags regarding fast-growing Axiom Legal Financing Fund

As investors continue to pour millions of pounds each month into Cayman Islands-domiciled Axiom Legal Financing Fund, OffshoreAlert has uncovered more red flags, including conflicting financial statements, £7.9 million loaned to a debt-ridden law firm owned by Axiom's principal, and insurance provided by an unregulated, unaudited firm that is currently defending a fraud lawsuit brought by one of its clients.

Uulala

As with Troy Hogg's Arbitrade Group, there's no crypto scheme too fraudulent for Bermuda's Premier, David Burt, to welcome with open arms. Thus it was again with California-based Uulala, which Burt personally approved to conduct the first authorized Initial Coin Offering in Bermuda, even recording a video that appeared on Uulala’s website in which he congratulated the firm for meeting “the Bermuda Standard" and boasting that Uulala's association with the jurisdiction would enhance its "reputation" and inspire "confidence" when seeking to attract investors. How low that standard is became apparent when OffshoreAlert revealed that Uulala’s principal, multi-level marketer Oscar Garcia, is a conman whose failed enterprises have led to a mountain of lawsuits, judgments, and tax liens alleging fraud or indebtedness. Burt approved Uulala in October 2018, OffshoreAlert exposed it in January 2019, and, two-and-a-half years later, Garcia and Uulala were sued by the U.S. Securities and Exchange Commission for an alleged $9 million digital tokens fraud, a lawsuit they settled for pennies on the dollar without admitting or denying the allegations. Garcia exploits his ethnicity to target his own community, particularly the poor, teaming up with The Latino Coalition when selling an MLM scam known as Lucrazon Global and then with the Association of Latino Professionals For America to push Uulala. An indication that Burt doesn't care about investors in, or clients of, Bermuda's blockchain firms is that, after OffshoreAlert informed him we had "uncovered dozens of lawsuits, judgments, liens, bankruptcies and/or regulatory actions in North America concerning directors, officers, and shareholders of Uulala and Arbitrade", he did not ask us for details and seemingly took no action against the company, at least not publicly.

EXPOSED: Bermuda cryptocurrency firms Uulala and Arbitrade

Two of Bermuda's new blockchain start-ups - Uulala Ltd. and Arbitrade Ltd. - are being operated by North Americans with long records of business failures, indebtedness, and scandal, OffshoreAlert can reveal.

Argentum Group

Litigation funding-based £98 million investment scam Argentum Capital was exposed by OffshoreAlert in February 2014. The company's shares were suspended by the Channel Islands Securities Exchange two days later, de-listed six days later, and the group collapsed two months later. Notably, one of the scheme's principals, Brendan Terrill, was later imprisoned in England after pleading guilty to sharing "indecent images of children" over the Internet, while another scheme principal, Duane McGaw, used some of his ill-gotten gains to open a restaurant in Canada and sue OffshoreAlert for libel. Chairman of one of the group’s funds was retired London High Court judge David Keene, who goes by ‘Rt. Hon. Sir David Keene’ and whose participation appeared to be that of a well-paid rent-a-name. When OffshoreAlert tipped off Keene that Argentum was a scam several weeks before we exposed it, he never even replied.

Argentum Capital litigation fund financed by £90M Ponzi scheme

London-based litigation fund Argentum Capital, whose shares are listed on the Channel Islands Securities Exchange and whose chairman is retired British judge David Keene, is being financed by what appears to be a £90 m Ponzi scheme headed by Briton Brendan Terrill and involving the BVI, Cayman Islands, Hong Kong, Jersey, Singapore, Thailand and other jurisdictions, OffshoreAlert can reveal.

Imperial Consolidated

Imperial Consolidated swindled clients out of more than $300 million via a range of offshore banking and investment products and services that it offered through dozens of companies domiciled in at least 11 countries, most notably the Caribbean island of Grenada and England, home of the group’s controlling principals, Lincoln Fraser and Jared Brook. After OffshoreAlert began exposing Imperial Consolidated in 1999, the group sued for libel in Miami but dropped the action after the judge ordered it to produce its financials as part of the discovery process. The group collapsed in 2002 and the United Kingdom’s Serious Fraud Office later brought criminal charges against Fraser, Brook, and others. Remarkably, the SFO never once contacted OffshoreAlert to ask for our testimony or mountain of documentary evidence and, as is typical of U.K. law enforcement, botched the prosecution, failing to secure guilty pleas against Fraser and Brook in two trials, probably causing another principal, Bill Godley, to rue his guilty plea. A minor consolation for victims was that, in a separate civil action in the U.K., Fraser and Brook were disqualified as company directors, albeit for a prior scam.

Imperial Consolidated Group's links to High Yield Investment Programs

Offshore Alert has obtained documents which implicate the Imperial Consolidated Group in the sale of investment programs purporting to offer guaranteed returns of as much as 30 per cent per month. In one program, Imperial Consolidated offers to pay a return of 9.25 per cent per month while simultaneously paying a 40 per cent commission to brokers who introduce investors.

Stirling Cooke

Two days BEFORE Goldman Sachs-controlled, Bermuda-based insurance broker Stirling Cooke Brown Holdings went public on NASDAQ in 1997 via a $50 million IPO at $22 per share, OffshoreAlert exposed the firm under the headline "Stirling Cooke - what you won't find in its prospectus", with our story detailing a plethora of red flags. Supported by 'buy recommendations' from Wall Street analysts who appeared to be incompetent or corrupt, Stirling Cooke's share price shot up to over $30 before the inevitable plunge to zero, de-listing, and, in 2003, bankruptcy. Apart from huge losses to investors, reinsurance claims estimated at $1 billion were voided as a result of the broker's fraud. Despite controlling Stirling Cooke throughout its fraud spree and refusing four offers from OffshoreAlert to show it evidence of wrongdoing at the beginning of our investigation, Goldman Sachs described its governance as "textbook" to the New York bankruptcy court and declared itself "blameless". Goldman Sachs later paid just $450,000 to settle a lawsuit brought by Stirling Cooke's Bankruptcy Trustee. Remarkably, the Goldman Sachs Managing Director - and Stirling Cooke director - who oversaw the fiasco, Reuben Jeffery III, went on to become Chairman of the U.S. Commodity Futures Trading Commission!

Stirling Cooke - What you won't find in its prospectus

Investors contemplating taking part in the $50 million IPO of Bermuda-based insurance broker/risk manager Stirling Cooke Brown Holdings Limited, which is 24 per cent owned by Goldman Sachs, may be interested in a few details they will not find in the company's share prospectus.

Perhaps the most noteworthy is the involvement of its subsidiary Raydon Underwriting Management in one of the world's largest insurance frauds.

Raydon, which shares offices with Stirling Cooke at Victoria Hall, Hamilton, had the dubious distinction of managing reinsurer North American Fidelity & Guarantee.

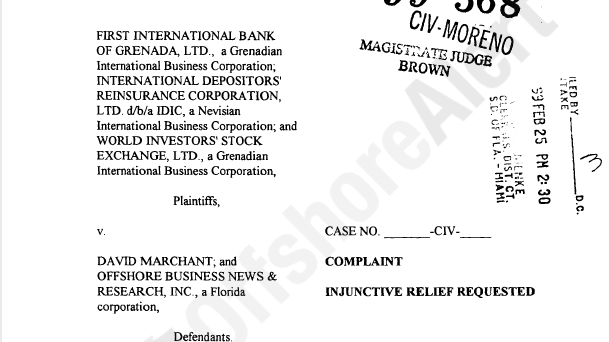

First International Bank of Grenada

In the late 1990s, the Government of Grenada licensed more than 40 offshore banks, virtually all of which were overtly fraudulent. Several of the licenses were given to the First International Bank of Grenada group, which had 182 telephone and fax numbers registered with Cable & Wireless in Grenada and, apart from banks, also included a stock exchange, an insurer, and a registered agent. With bogus initial capital of $32 million, comprising worthless shares in a sham investment fund that had false NAVs and a photo of a ruby that it did not even own, FIBG took in more than $200 million from investors who were offered annual interest of up to 250% and told their principal and returns were “insured” and “guaranteed”. After OffshoreAlert exposed FIBG in 1999, the bank sued for libel at federal court in Miami and sought an injunction to prevent further publication, supported by an affidavit from Grenada’s financial services regulator, Michael Creft. When five of the bank’s principals were criminally indicted in Oregon two years later, Creft admitted to U.S. prosecutors that he had committed perjury when testifying against OffshoreAlert in the libel action and that he and Grenada’s Prime Minister, Keith Mitchell, had received bribes from FIBG. After the bank collapsed, two of its principals fled to Uganda, where they were arrested in a shoot-out with police in which their bodyguard was killed and deported to the U.S., where they and three others had been indicted for fraud and money laundering. One defendant died pending trial and the other four pleaded guilty to money laundering, for which they received prison terms.

OffshoreAlert exposes massive offshore banking and insurance fraud

Offshore Alert can today expose a massive fraud involving at least three banks, an insurance company and a stock exchange into which investors are believed to have invested tens of millions of dollars. Participants in the scam include the World Investors Stock Exchange in Grenada, the International Deposit Insurance Corporation in Nevis, the First International Bank of Grenada, the International Exchange Bank, which is registered in either Nauru or Grenada but operated out of Bermuda and Texas; and Fidelity International Bank, which is registered in Nauru but operated from St. Vincent.

World-Check

It’s ironic that U.S. banks sought to comply with an AML law passed as a result of 9/11 by subscribing to a database promoted around a lie about that very event. Yet that’s what happened in 2002 when British firm World-Check and its founder, South African David Leppan, shamelessly and repeatedly claimed their PATRIOT Act compliance database had profiles of 15 of the 19 hijackers BEFORE the attacks, with one news article even suggesting the attacks could have been prevented if the U.S. Government had been a subscriber. However, OffshoreAlert revealed that World-Check only created profiles of the hijackers when the U.S. Department of Justice released their names three days AFTER 9/11. Under Leppan’s control, World-Check also fabricated an endorsement quote from the U.S. Department of Homeland Security, entered into a suspicious offshore tax arrangement that converted revenue into expense, and included entities in its “high-risk” database simply for being members of the Cayman Islands Chamber of Commerce. It worked, however, because Leppan made tens of millions of dollars when he sold World-Check.

False claims about World-Check and the 9/11 terrorists

Claims in news articles that a British provider of Know Your Customer information to financial institutions had the names of 15 of the 19 September 11 hijackers in its due diligence database BEFORE the attacks are false, OffshoreAlert can reveal.Global

Keith Mitchell

In the late 1990s, Grenada opened its doors to fraudsters, licensing more than 40 offshore banks that collectively swindled foreign investors and depositors out of hundreds of millions of dollars in a variety of crude scams. It was all done with the support and protection of Grenada's Prime Minister, Keith Mitchell, who received bribes from the banks, according to testimony provided to US prosecutors by Grenada's former financial services regulator Michael Creft, who also admitted that he too was bribed. In 2004, OffshoreAlert also revealed an allegation that Mitchell had received a cash bribe of $500,000 from US fraudster Eric Resteiner in return for appointing Resteiner to a diplomatic position. Remarkably, Mitchell admitted to OffshoreAlert in a telephone interview that he did indeed receive cash from Resteiner but claimed that it was "only" about $14,000 and it was for "reimbursement of expenses". A few years later, a U.S. Department of Justice source told OffshoreAlert that Resteiner had shown U.S. agents a video recording of him bribing Mitchell in the hope of receiving leniency on fraud charges that he faced at federal court in Massachusetts regarding a $47 million investment scam that he had perpetrated. This account was confirmed by Resteiner’s counsel in a court filing. A Commission of Inquiry was set up in Grenada to look into the allegation but it appeared to be as corrupt as the conduct it was supposed to be looking into and Mitchell was cleared.

OffshoreAlert exposes massive offshore banking and insurance fraud

Offshore Alert can today expose a massive fraud involving at least three banks, an insurance company and a stock exchange into which investors are believed to have invested tens of millions of dollars. Participants in the scam include the World Investors Stock Exchange in Grenada, the International Deposit Insurance Corporation in Nevis, the First International Bank of Grenada, the International Exchange Bank, which is registered in either Nauru or Grenada but operated out of Bermuda and Texas; and Fidelity International Bank, which is registered in Nauru but operated from St. Vincent.

Caribbean Bank of Commerce

In 1998, OffshoreAlert revealed that the Caribbean Bank of Commerce was being operated by Russian fraudsters and that, after being struck off the corporate register in Antigua and Barbuda, continued operating, claiming it was 'licensed' by the 'Dominion of Melchizedek', which was a fake country created to facilitate fraud. Caribbean Bank of Commerce’s principal, Eugene Chusid, was later imprisoned for 37 months and ordered to pay penalties totaling $610,000 at federal court in New York after pleading guilty to fraud involving the bank. During our investigation, OffshoreAlert's publisher received a threatening call from someone with a Russian accent who described himself as the bank's "head of security" and, in a thinly-veiled threat, warned: "You don't know who you're dealing with."

'Caribbean Bank of Crooks'

Offshore Alert can this month reveal further details about an Internet bank in Antigua that is perpetrating a fraud so crude that it illustrates why the island has developed such a poor reputation in the offshore world.

The fraud is all the more disturbing because the bank's legal representative in Antigua is Steadroy Benjamin, who is a Senator for the ruling Antigua Labour Party and is the Deputy Speaker of the Antiguan House of Representatives.

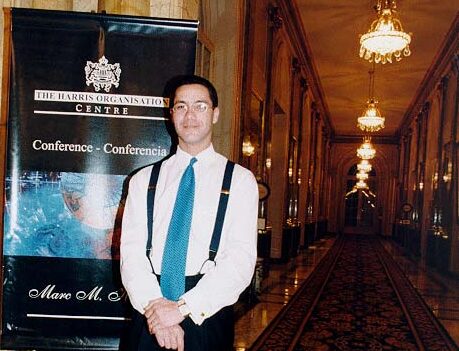

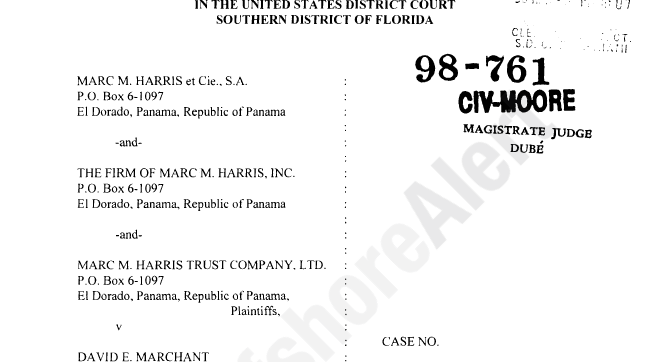

Marc Harris

OffshoreAlert's first big exposé came on March 31st, 1998 when we revealed that The Harris Organization, which was a financial services group based in Panama and headed by American CPA Marc Harris, was providing fraud and money laundering services to clients, had stolen millions of dollars from those same clients, and was "hopelessly insolvent". The Harris Organization filed a criminal defamation complaint against OffshoreAlert in Panama and a civil defamation complaint in Florida, the latter of which was tried over six days and concluded with a judgment in favor of OffshoreAlert, which triggered The Harris Organization's collapse. Harris fled to Nicaragua, where he was arrested while his car waited at traffic lights and deported to the U.S., where there was a sealed indictment against him in Florida. Harris was convicted on multiple counts of fraud and money laundering at trial and sentenced to 17 years in prison. His number two, Larry Gandolfi, and several clients were also criminally convicted in the U.S., mostly for tax fraud.

The Harris Organization's multi-million dollar Ponzi scheme

Offshore Alert can today disclose that Panama's most-hyped financial services group, known as The Harris Organization, is being run as a massive Ponzi scheme in which clients are being defrauded out of millions of dollars.

The situation is so serious that The Harris Organization, which employs 150 people in Panama, is hopelessly insolvent, with net liabilities of at least $25 million, according to sources knowledgeable of the group's financial affairs.