Richard Fagan

February

2023

Stuart Coles: Amended $44.8K Fine & Disqualification (Dubai)

Amended Decision Notice by the Dubai Financial Services Authority imposing a fine of $44,800 and industry ban on Stuart Coles, a citizen of the United Kingdom.

November

2022

Kijani Resources Ltd. et al v. Richard Fagan et al: Judgment (‘Default Judgment Application’)

Judgment on default judgment application in Edgar Lavarello and Simon Conway, as Joint Liquidators of Kijani Resources Limited (in Liquidation) and Ratio Limited (in Liquidation) v. Richard Fagan, Simon Hooper, Lisa Billington, and William Redford at the Supreme Court of Gibraltar.

September

2022

‘Remove my name from Belvedere Group article or I’ll sue’, writes Gibraltar service provider Philip Cartwright

Letter from Gibraltar-based corporate services provider Philip Cartwright threatening to sue OffshoreAlert unless we removed his name from an article about the now-defunct, fraudulently-operated Belvedere Group in which he was identified as a director of Ratio Enterprises Limited, which was part of Belvedere client Richard Fagan’s fraudulent Ratio Group. In subsequent correspondence, Cartwright informed OffshoreAlert in writing that “I have never been a director of a company called Ratio Enterprises Limited”. OffshoreAlert then emailed him a copy of Ratio Enterprises’ 2011 annual return with Gibraltar’s Companies House that he himself signed and in which he twice identified himself as a director of the company.

August

2022

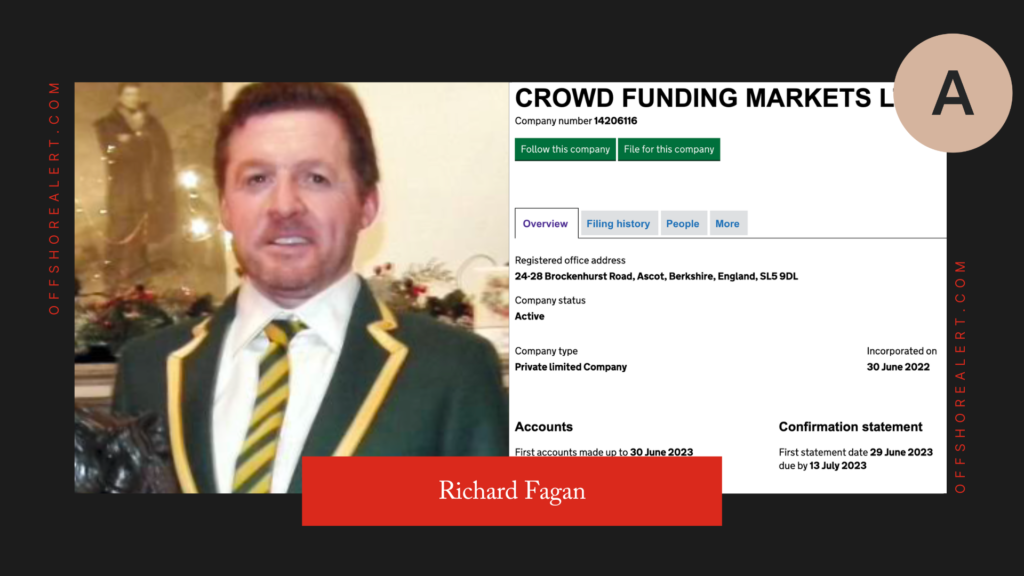

UAE-based investment fraudster Richard Fagan forms British firm Crowd Funding Markets

United Arab Emirates-based, British and Irish serial investment fraudster Richard Fagan has set up a new company in England called Crowd Funding Markets Ltd. and is also involved with a $4 million offering of shares in Dubai-domiciled Essentially Juices Manufacturing LLC, OffshoreAlert can reveal.

July

2022

Dubai regulator fines & bans U.K. national Stuart Coles after OffshoreAlert exposé

An investigation by the Dubai Financial Services Authority that was triggered by an OffshoreAlert exposé has resulted in a $240,000 fine and industry ban for United Kingdom national Stuart Coles and public censures for three of his companies, Coworth Investments, Coworth Fintech, and Novus Fintech.

June

2022

Kijani Resources Ltd. et al: Investor Notice (‘Simon Hooper Approach’)

‘Investor Notice’ by PwC, as liquidators of Kijani Resources Limited and Ratio Limited, both of Gibraltar, warning them about a solicitation from Simon Hooper, a British convicted fraudster whom the liquidators described as “a former director of both companies”, regarding the Kijani Commodity Funds.

April

2022

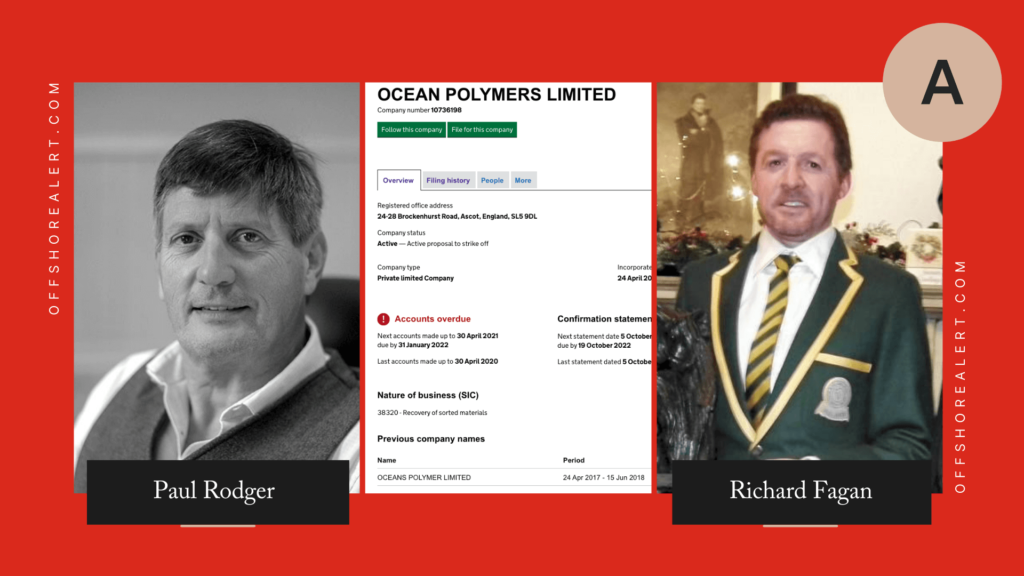

Richard Fagan-linked Ocean Polymers staves off compulsory strike-off

A seemingly fraudulent British company that has raised £1.4 million from investors to ‘clean up the world’s oceans’ has belatedly filed its annual accounts to stave off forced dissolution. Ocean Polymers Ltd. filed its 2021 accounts two months’ late on April 1st – one day after OffshoreAlert asked the firm’s principals about a compulsory strike-off action by the Registrar of Companies.

March

2022

Stuart Coles: $240K Fine & Disqualification (Dubai)

Decision Notice by the Dubai Financial Services Authority imposing a fine of $240,000 and industry ban on Stuart Coles, a citizen of the United Kingdom.

March

2022

Novus Fintech Ltd.: Public Censure

Decision Notice b the Dubai Financial Services Authority that it has imposed a Public Censure on Novus Fintech Ltd., whose “sole owner and director” was identified as Stuart Coles, a citizen of the United Kingdom.

March

2022

Coworth Investments Ltd.: Public Censure

Decision Notice by the Dubai Financial Services Authority imposing a Public Censure on Coworth Investments Ltd., whose “sole owner and director” was identified as Stuart Coles, a citizen of the United Kingdom.

March

2022

Coworth Fintech Ltd.: Public Censure

Decision Notice by the Dubai Financial Services Authority that it has imposed a Public Censure on Coworth Fintech Ltd., whose “sole owner and director” was identified as Stuart Coles, a citizen of the United Kingdom.

March

2022

Kijani Resources Ltd. v. Richard Fagan et al: $134M Judgment Application

Application for a default judgment in the amount of $134 million against Richard Fagan, Simon Hooper, and William Redford in Edgar Lavarello and Simon Conway, as Joint Liquidators of Kijani Resources Limited (in Liquidation) v. Richard Fagan, Simon Hooper, Lisa Billington, and William Redford at Gibraltar Supreme Court.

March

2022

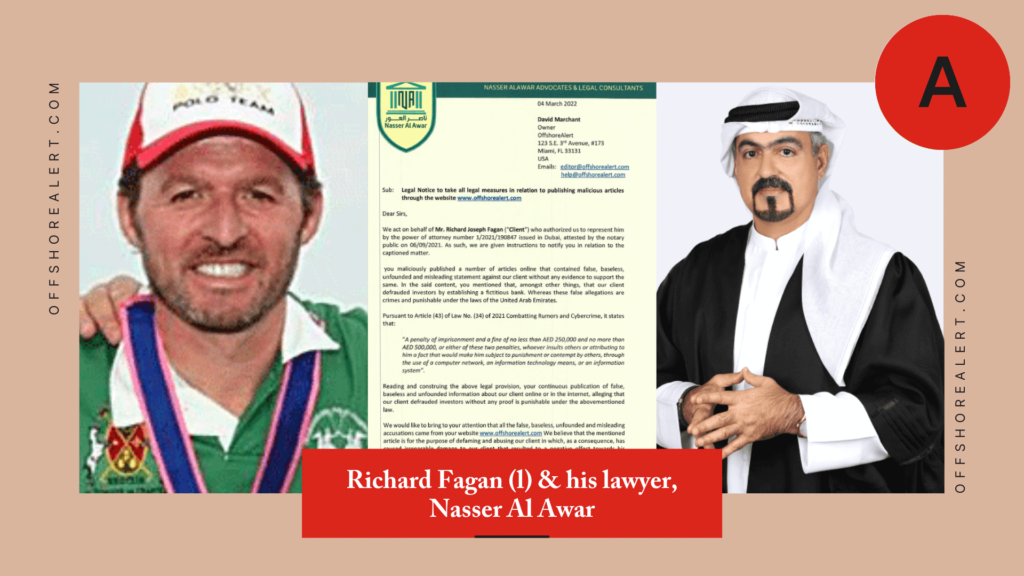

Fraudster Richard Fagan ‘makes criminal complaint against OffshoreAlert in Dubai’, claims ‘psychological and moral harm’

British and Irish national Richard Fagan has filed a criminal defamation complaint against OffshoreAlert with Dubai Police nearly seven years after we first exposed him as an investment fraudster, according to his local lawyer, Nasser Al Awar, who is described on his law firm’s website as “a retired Dubai Police brigadier”.

March

2022

‘Apologize, Retract & Remove Content,’ writes fraudster Richard Fagan’s Dubai lawyer, Nasser Al Awar

Letter from Dubai-based lawyer and former policeman Nasser Al Awar demanding the removal of content, a retraction, and an apology on behalf of his client, British/Irish national Richard Fagan, whom OffshoreAlert has previously exposed as a serial investment fraudster.

November

2021

Kijani Resources Ltd. et al v. Richard Fagan et al: Complaint (‘$82M Fraud’)

Particulars of Claim in Edgar Lavarello and Simon Conway, as Joint Liquidators of Kijani Resources Limited and Ratio Limited v. Richard Fagan, Simon Hooper, Lisa Billington, and William Redford at the Supreme Court of Gibraltar.

November

2021

Coworth Investments Ltd. et al: Dubai FSA’s ‘Regulatory Clarification’

Dubai Financial Service Authority’s “Clarification regarding the regulatory status” of Coworth Investments Ltd., Coworth Fintech Ltd., and Novus Fintech Ltd. Editor’s Note: As previously reported by OffshoreAlert, Coworth and Novus are part of a group controlled by British fraudster Richard Fagan.

September

2021

British fraudster Richard Fagan’s Coworth Investments reports net liabilities of £500K

British firm Coworth Investments Ltd., which is operated by British and Irish serial fraudster Richard Fagan, has reported net liabilities of £559,494 in its latest financials.

September

2021

Coworth Investments Ltd.: 2020 Accounts

Unaudited Financial Statements for 2020 of Coworth Investments Ltd., filed with Companies House for England and Wales.

September

2021

Michael McDaid v. Novus Fintech Ltd.: Order of Execution

Order of Execution in Michael McDaid, a citizen of the United Kingdom v. Novus Fintech Limited at the Dubai International Financial Centre Courts.

August

2021

Michael McDaid v. Novus Fintech Ltd.: Judgment

Judgment regarding an employment dispute in Michael McDaid v. Novus Fintech Limited, of Dubai, at the Dubai International Financial Centre Courts. Editor’s Note: Novus Fintech Limited was exposed as a fraud by OffshoreAlert in February 2021. The company is operated by United Kingdom national Stuart Coles and is part of a group whose principals include British/Irish serial investment fraudster Richard Fagan.

July

2021

Retired soccer player Mikaël Silvestre teams up with fraudsters Richard Fagan & Stuart Coles

Former France and Manchester United professional soccer player Mikaël Silvestre has gone into business with British fraudsters Richard Fagan and Stuart Coles, OffshoreAlert can reveal.

March

2021

Fraudster Simon Hooper receives non-custodial sentence in England

British serial fraudster Simon Hooper, 46, has received a non-custodial sentence in England for a scam involving British firm Rationale Investments Limited.

February

2021

Richard Fagan’s British polo fraudsters set up fake ‘Swiss bank’ & attempt Cayman fund take-over

Middle East-based British polo players led by Richard Fagan who fund their lavish lifestyles through investment fraud have set up a fake ‘Swiss bank’ and are trying to take over a Cayman Islands fund, OffshoreAlert can reveal.

September

2020

Simon Hooper pleads guilty to fraud in England

United Kingdom national Simon Hooper has pleaded guilty to three counts of fraud involving British firm Rationale Investments Limited, which purports to be a property investment firm.

August

2020

Despite fraud charges, Briton Simon Hooper becomes director of 8 British firms

Undeterred by fraud charges on which he is due to be tried in England next month, U.K. national Simon Hooper, who is part of an international gang of serial fraudsters previously exposed by OffshoreAlert, recently became a director of eight British firms.

October

2019

Briton Simon Hooper charged with fraud – 4 years after being exposed by OffshoreAlert

Briton Simon Hooper, who was exposed as a fraudster by OffshoreAlert four years ago, has been charged with fraud in England regarding his latest firms, Rationale Asset Management Plc and Rationale Investments Ltd.

July

2019

Kijani Gibraltar liquidators to sue NatWest Bank for ‘dishonest assistance’ to $98M fraud

The liquidators of Gibraltar-domiciled Kijani Resources Ltd. and Ratio Ltd. intend to sue NatWest Bank for “dishonest assistance” to a $98 million fraudulent scheme headed by Irishman Richard Fagan that collapsed in 2015 after being exposed by OffshoreAlert.

January

2017

Blackfriars Holdings Ltd. et al v. Richard Oliver Fagan: Defense & Counterclaim

Defense and Counterclaim in Blackfriars Holdings Ltd. and Corinthian Trust Company Limited, in its capacity as The Trustees of the Equitable Trust, v. Richard Oliver Fagan at the High Court of Justice of England and Wales.

December

2016

Blackfriars Holdings Ltd. et al v. Richard Oliver Fagan: Complaint

Complaint in Blackfriars Holdings Ltd., of the British Virgin Islands, and Corinthian Trust Company Limited, of Gibraltar, as Trustee of the Equitable Trust, v. Richard Oliver Fagan, of England, at the High Court of Justice for England and Wales, Chancery Division.

September

2016

Blackfriars Holdings Ltd. et al v. Richard Oliver Fagan: Claim Form

Claim Form in Blackfriars Holdings Ltd., of the British Virgin Islands, and Corinthian Trust Company Limited, of Gibraltar, as Trustee of the Equitable Trust, v. Richard Oliver Fagan, of England, at the High Court of Justice for England and Wales, Chancery Division.

November

2015

Cayman Islands Monetary Authority v. Brighton SPC: Liquidators’ First Report

October

2015

Cayman Islands Monetary Authority v. Brighton SPC: Reasons for Winding Up

Reasons for Winding Up Order in Cayman Islands Monetary Authority v. Brighton SPC at the Grand Court of the Cayman Islands.

September

2015

Cayman regulator applies to liquidate Belvedere’s Brighton SPC, cites ‘fraud’

Nearly six months after an OffshoreAlert exposé, the Cayman Islands Monetary Authority has petitioned to wind up Belvedere Management Group investment vehicle Brighton SPC, citing evidence of fraud “from inception” in which at least US$83 million of investors’ funds has disappeared.

September

2015

Cayman Islands Monetary Authority v. Brighton SPC: Winding Up Petition

June

2015

Belvedere’s Brighton SPC taken over by Cayman regulator

Belvedere Management Group fund vehicle Brighton SPC, which was exposed as a fraud by OffshoreAlert 11 weeks ago, has been taken over by the Cayman Islands Monetary Authority following the completion of a “forensic examination” by the regulator.

May

2015

BUSTED: British & Irish expats who help Belvedere Group swindle investors

One day after new directors were appointed to ‘ensure’ that Cayman-domiciled Brighton SPC would be operated legally, the Fund illegally acquired a Gibraltar firm with bogus assets of $125 million, OffshoreAlert can reveal. The transfer allowed Belvedere and its accomplices in Britain, Dubai, Gibraltar, Spain and elsewhere to continue securities frauds involving firms listed on stock exchanges in Denmark, England and Germany.

March

2015

Cayman hedge fund Brighton SPC suspended in aftermath of Belvedere Management Group exposé

Cayman Islands-domiciled hedge fund Brighton SPC has been suspended by its directors, David Egglishaw and John Cullinane, after OffshoreAlert revealed it was part of a criminal financial enterprise operated by Mauritius-based Belvedere Management Group.

March

2015

EXPOSED: Belvedere Management’s massive criminal enterprise

Offshore fund group Belvedere Management, which claims to have $16 billion of assets under administration, management and advisory, appears to be one of the biggest criminal financial enterprises in history, headed by David Cosgrove, Cobus Kellermann and Kenneth Maillard, OffshoreAlert can reveal.